KPKT Digital Lending Platform

6-8 weeks

Complete lending platform with application processing, underwriting, and collections.

A complete digital lending platform with automated underwriting, loan management, payment processing, and regulatory compliance. Built for Malaysian KPKT lenders seeking to digitalise their lending and collections workflow.

Key Features

Automated Loan Underwriting

Configurable approval workflows with risk assessment and decision engines

Integrated Payment Processing

Multiple payment gateway integrations with automated collections

Comprehensive Audit Trails

Complete regulatory compliance and audit documentation

Customer Web Portal

Self-service portal with mobile application support

Admin Web Portal

Real-time reporting with role-based access control and approval workflows

Digital Signing & eKYC

Compliant identity verification and document signing workflows

WhatsApp Integration

OTP delivery and automated notifications via WhatsApp

Platform Modules

Comprehensive modules designed for complete digital lending operations, from onboarding to collections.

Core Modules

Essential modules that power your lending operations

Loan Application Dashboard

OnboardingStreamlined application processing with application resuming

Borrower Loan Management

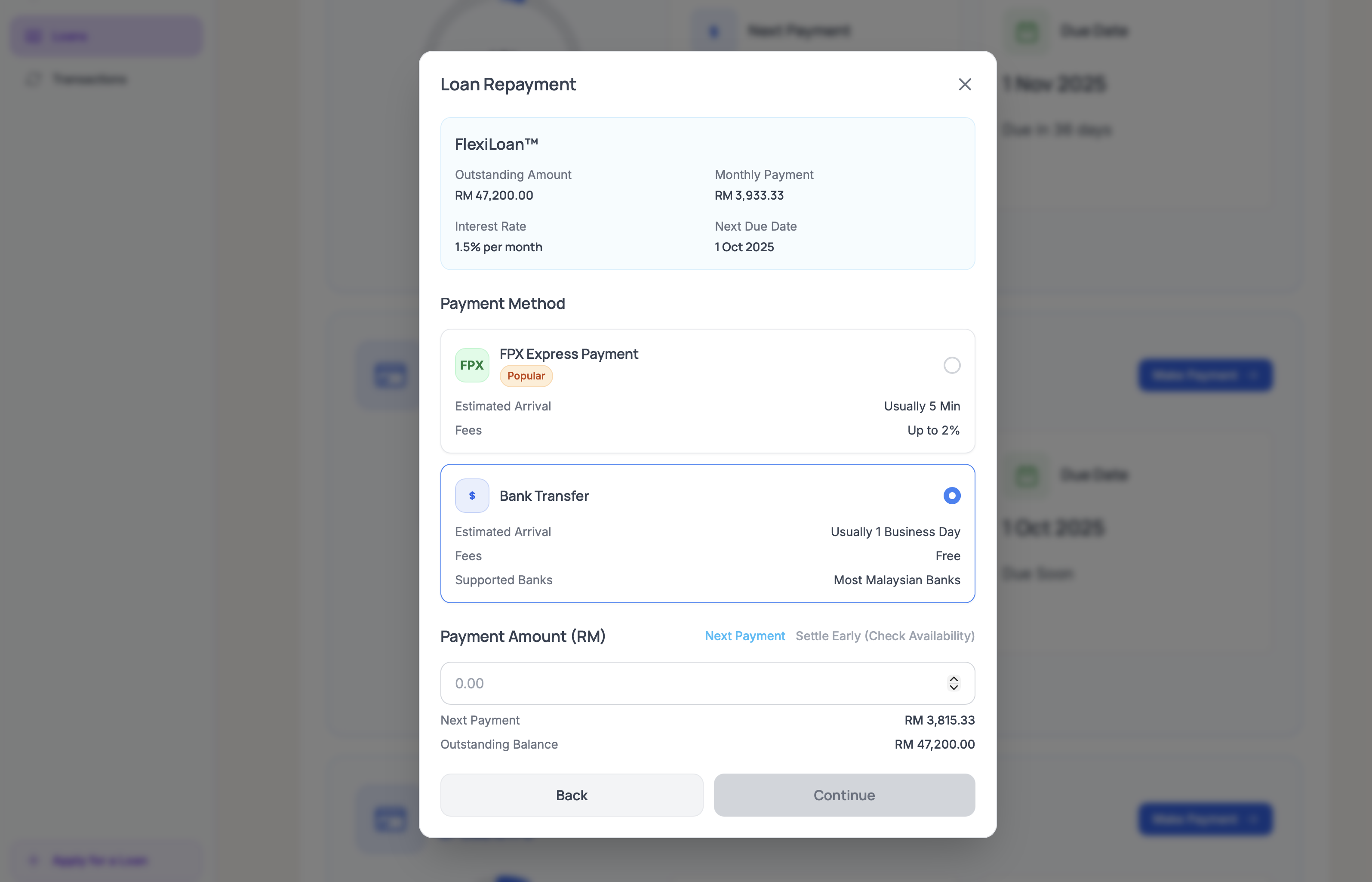

Loan ManagementBorrower dashboard with loan status and repayment trackings

Receipt and Default Letters

ReceiptsAutomated receipt and default letter generation

Collections Management

CollectionsAutomated collection workflows with WhatsApp integration

Comprehensive Reporting

ReportingAdmin reporting dashboard with real-time metrics and analytics

Payments

PaymentsAutomated payment processing and collections

All Platform Modules

📊 Modules with detailed interface previews shown above

Third-Party Integrations

Seamless integration with leading Malaysian and international service providers

Customization Note: All modules and interfaces can be fully customized to match your branding, workflows, and specific business requirements. Screenshots show representative interfaces that will be tailored during implementation.

Security & Compliance

RBAC, end-to-end encryption, comprehensive audit logs, OAuth 2.0 API security, on-premise deployment options

Implementation Timeline

Our structured approach ensures smooth deployment with clear milestones.

Discovery & Setup

- Requirements gathering and business process mapping

- KPKT compliance framework analysis and setup

- Environment provisioning and initial configuration

- Integration planning with Malaysian CAs and payment gateways

Core Configuration

- Loan management and underwriting workflow setup

- eKYC and digital signing integration

- WhatsApp Business API integration and testing

- Credit scoring engine configuration with CTOS

Advanced Features & Branding

- Collections workflow and automated notifications setup

- Compliance audit trails and reporting configuration

- Branding implementation and UI customization

- On-premise server setup and attestation services

Testing & Deployment

- End-to-end testing with real-world scenarios

- Staff training and documentation handover

- Security review and compliance validation

- Production deployment and go-live support

Branding Options

Complete customization to match your brand identity and user experience requirements.

Example Reference

kredit.my

A successful implementation demonstrating the platform's capabilities in production.

Visit kredit.my →Ready to get started?

Request a demo to see how KPKT Digital Lending Platform can be customized for your specific needs.

Request a demo